Airline Advisory Solutions -

Avia introduces a suite of new Airline Advisory Solutions

New air service feasibility planning for airlines

Objective deep dive analysis of an airline’s strategy

Planning dashboard to enable smart airline fleet decision making

On-site review of an airline commercial or operational performance

Launch planning program for new airline start-ups

Long-haul low cost carrier feasibility planning or defense analysis

AviaSolutions has introduced a suite of new airline advisory products designed to enable airline leadership teams to make better informed decisions and to drive improved company performance.

These new products have been created based on feedback from airline clients around the world over the past year. They have been shaped to focus specifically on an airline’s network, strategy, fleet, commercial performance, technical performance and new airline start-ups, whilst reflecting the latest market trends.

These products stand alongside Avia’s existing airline solutions and our extensive suite of airports and route development solutions.

If you see a need for solutions like this at your airline, or if you would like more clarity on how they can be delivered, please feel free to contact the AviaSolutions Airlines team today, by e-mailing either John Carter or Andrew Rowsell.

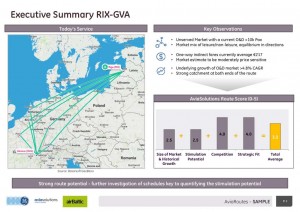

aviaroutes

is a product devised to rapidly ascertain the feasibility of potential new air services at small and medium size airlines.

Avia Solutions will assess four key metrics for a series of potential routes and an overall score as to indicate the likelihood of success. These metrics are:

1. Size of market & historical growth

2. Stimulation potential

3. Competition

4. Strategic fit

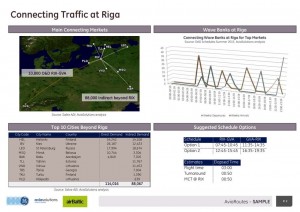

The assessment of potential new routes will be informed by a number of input factors:

• Historical traffic

• Airport catchment area profiles

• Yield

• Connecting traffic

• Seasonality

• Directionality

• Competitive landscape

• Access to Sabre MI indirect traffic flow data

Client airlines have the choice to select a study of 3, 6 or 9 routes using a fixed price mechanism. Additionally, airlines have the option to request further analysis at an agreed price. For example, QSI analysis, route economics, impact studies, and schedule changes.

aviaroutes is targeted to the teams involved with air service development, route and network planning and the scheduling of small/medium sized airlines which do not have access to traffic data and are not very sophisticated. For small airlines this could also be presented to the CEO level or to the board to validate decisions made by the management team.

aviastrategy

The airline industry continues to be driven by the economic cycle, intense competition, external geopolitical forces, capital intensity and low profit margins. And that is in the good days of low fuel prices and low interest rates.

Airlines prosper by reacting quickly to constant change; by imposing cost reductions where feasible and attempting revenue growth where possible. Should full service carriers move upwards and away from Low Cost Carrier (LCC) competition or should they embrace it with their own LCC, or can they even do both? What is the future for LCCs, as the lines between business models become ever more blurred? Can regional carriers remain unaligned to network carriers or do they need to embrace cooperation? How can carriers compete against the giant Middle East Three?

aviastrategy is a direct response to the need for simplicity amongst such complexity. It is a strategic deep dive analysis for an airline top level management and board to understand their strengths and weaknesses, their opportunities and threats. It is designed for the medium to large sized airlines.

aviastrategy addresses an airline management team’s biggest challenges, assesses the most important drivers of an airline’s success and provides a series of relevant recommendations to the airline’s management/board, all supported by Avia Solution’s proven track record of delivery as well as GECAS unparalleled reputation.

Recent aviastrategy projects have been conducted at leading flag carrier airlines

in Asia and the Middle East.

aviafleet

What is the best acquisition model for each aircraft type an airline is considering? Does an airline have an up-to-the-minute view of the balance sheet exposure of its fleet? Are some types better acquired through operating leases and others through finance lease? When is the best time to plan an aircraft’s exit from the fleet?

These are complex questions that can determine an airline’s overall success which can only be answered through sophisticated and informed analysis models made more complex by responses that change week by week, month by month, and above all, type by type.

aviafleet is a new planning dashboard from Avia Solutions that provides the tools that enable airline management to make smart airline fleet decisions. It displays an estimate of the current market value (CMV) of a fleet in relation to its book value, based on the airline’s depreciation policy and expert appraisers’ aircraft market values. Aircraft currently on finance lease can also be assessed for future values based on when they will become airline assets.

The aviafleet dashboard is informed by multiple data points for each aircraft MSN (manufacturer serial number) in the fleet, as each has its own age profile, remaining maintenance life and ownership model. With every aircraft in the fleet assessed, an amalgamated fleet exposure valuation can be made, which will enable an airline to plan fleet rollover or expansion in a more informed way.

aviafleet is targeted at the CFO, Fleet Planning Director and CEO of medium to large airlines around the world.

aviaquality

In a competitive and relentless industry, it is often difficult for an airline management team to know precisely how it is performing versus peer airlines in its market.

Is there room for improved revenue management performance? Are there new fuel saving innovations available that could benefit your airline? How does the maintenance cost and dispatch reliability of your fleet compare to other similar airlines around the world.

aviaquality is a new performance review tool designed to assess how an airline is performing on key metrics against its peer group. It is focused on two main arenas at the airline:

• Commercial: yield management, network planning, sales strategy, marketing strategy, financial planning, execution

• Operational: flight operations, ground operations, maintenance costs, fuel management, ULD management, scheduling

aviaquality offers an effective and efficient onsite audit program with our expert team to be able to ensure an airline is performing to the best of its ability and to make sound recommendations for improvement when it is not. Straightforward and implementable recommendations for change are possible following an aviaquality performance review.

An aviaquality operational review has just been completed at a Latin American airline, which identified a series of areas of improvement that the airline could exploit, which could help cut operating costs by up to 3%. Airline feedback to this review has been very positive.

aviarunway

Pioneer investors continue to seek opportunities to establish new airlines with profitable and defendable market positions.

In more mature markets, the recent focus has been to create innovative business models for specific market niches, such as those of Vueling, Allegiant and Spirit. Certain major airlines are evolving towards a portfolio approach, with multiple business models within a group to address distinct market needs. SIA, Qantas and IAG are examples.

In emerging markets, rising personal incomes are creating opportunities for more people to experience the value of air travel, to be connected with their business, friends and families. Savvy investors, like those behind Lion Air, Cebu Pacific and Azul, can achieve first-mover advantage and market leadership.

aviarunway is a product to assist new airline projects with proven set-up planning, methodology and tools. We set out to fully understand the market potential through detailed traffic, yield and cost analysis to understand how a new airline should be competitively positioned. Our fleet plan advice will set out a feasible aircraft acquisition and introduction strategy. We will build a cost and revenue model to understand potential profit and economic drivers. Detailed project management timelines will indicate the key decisions and tasks to be undertaken by the new airline’s leadership team.

Implementing an aviarunway solution will allow the new airline leadership team to work toward its Air Operator’s Certificate (AOC) application, fleet introduction, technology roll-out and service launch.

aviaLCCX

The Low Cost Carrier (LCC) business model accounted for 24% of all seats sold around the world in 2015. In some regions, the LCC share is much higher – Europe at 33%, Latin America at 35%, SE Asia at 42%.

More recently, the LCC model has broken free of its short haul focus, and begun to enter medium and long haul markets, until now the exclusive domain of full service carriers. Already, the first long-haul low cost carriers have gained a foothold on North Asia to South East Asia and Asia to Pacific routes, with first steps also being taken on the lucrative transatlantic market.

These brave, first long-haul carriers have used the tools learned at LCCs – low cost operations, high ancillary revenues, new technology aircraft to drive meaningful unit cost differentials to full service competitors. Full service carriers have for the most part been standing back to observe, although some have decided to enter the fray with their own LCCX subsidiaries (SIA with Scoot, Qantas with Jetstar, Air Canada with Rouge, Lufthansa with Eurowings).

But does the long haul low cost carrier model really work? What are the key success factors for this model? What are the right aircraft types for this model? What is the optimal stage length? Are there financial returns to prove its merit?

aviaLCCX is a new product designed to answer those questions for specific situations. The product is designed both for investors looking at the returns available for the LCCX business model, for LCCs wondering if they should launch long haul operations and for full service carriers looking to defend against it.

With a dedicated LCCX cost and revenue model in place to analyse each specific market opportunity and significant in-house LCCX business model expertise within our team, AviaSolutions is the Long-Haul Low